coinbase pro taxes uk

Login To Your Coinbase Pro Account. I havent cashed out for a couple of years but saw they had finally integrated this function to be able to withdraw directly.

Jesse Edwards One Of The Co Founders Of R3 Has Left The Enterprise Blockchain Company Coindesk Has Learned Edwar Blockchain Stock Exchange Software Sales

If you are in the following states then your threshold for receiving a 1099-K is much lower.

. As first reported by Decrypt the popular crypto exchange emailed some users saying that as part. Non-US customers will not receive any forms from Coinbase and must utilize their transaction history to fulfil their local tax obligations. The software also calculates your gains and losses.

Full support for US UK Canada and Australia and partial support for others. Very important to follow instructions exactly as seen to avoid errors. The good news is while Coinbase Pro might not provide tax forms and documents Coinbase Pro does offer 2 easy ways to export transaction and trade history.

Coinbase may update the conditions for eligibility at any time. Download your tax reports in minutes and file with TurboTax or your own accountant. Subscribe to my YouTube cryptowendyo Leo H Cascharlydesmother user8864591378788finallyfedup Coinbasecoinbase CompleteHQcompletehq.

This matters for your crypto because you subtract. 12570 Personal Income Tax Allowance. Explore the latest videos from hashtags.

On Coinbase and Coinbase Pro all taxable transactional history can be recorded by third-party crypto tax calculating software automatically and on all exchanges. The UK taxman has scored a success in its ongoing attempts to obtain details about UK holders of crypto-currencies. She has three years of reporting experience on a wide variety of tech-related topics.

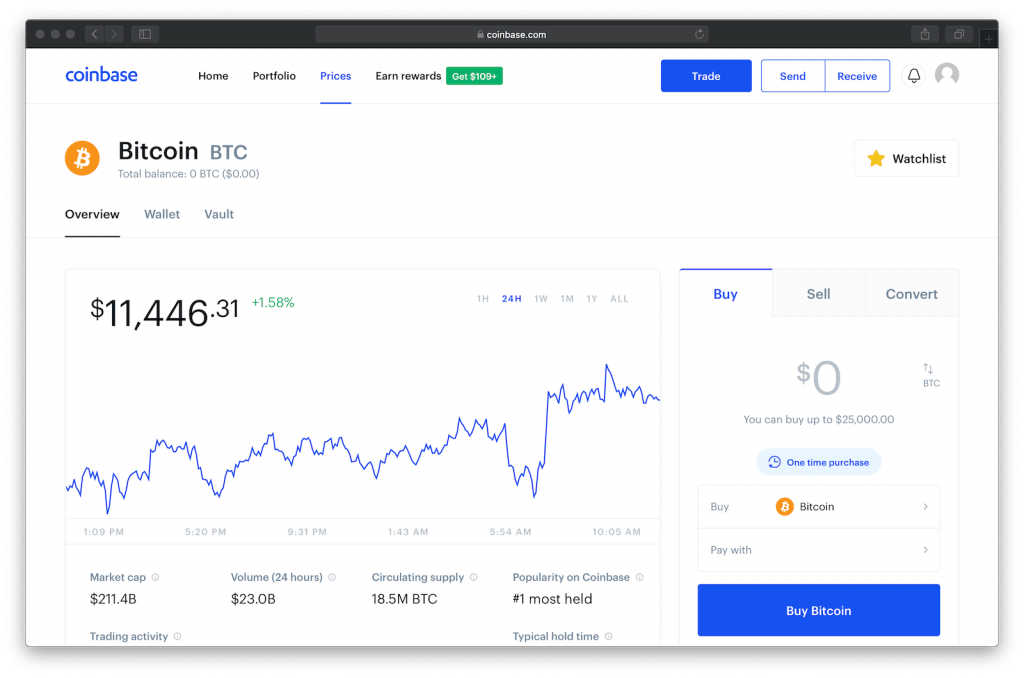

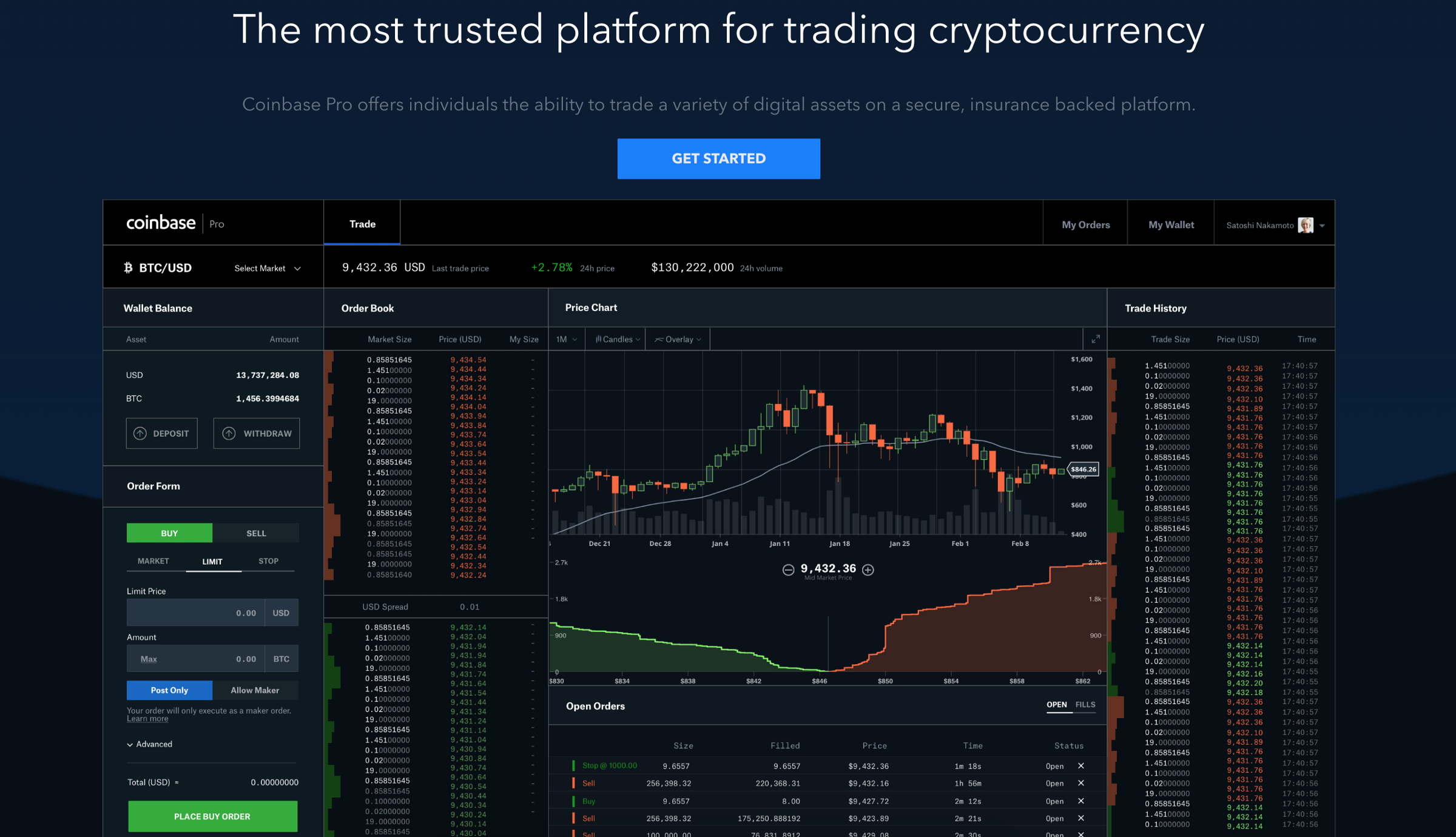

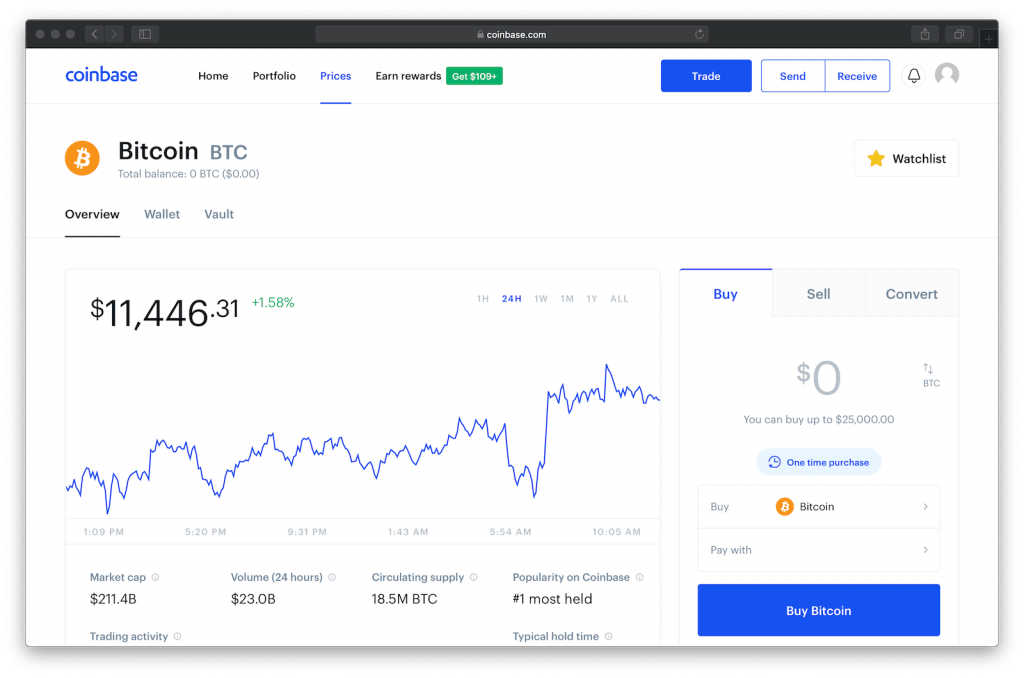

You can generate your gains losses and income tax reports from your Coinbase Pro investing activity by connecting your account with CryptoTraderTax. Coinbase and Coinbase Pro differ in fee structures with Coinbase being more expensive and complicated to understand. Watch popular content from the following creators.

Coinbase introduces helpful way to file crypto taxes. The Coinbase cryptocurrency platform is getting ready to send over details of some of its United Kingdom-based customers to the Tax Authority in the country. Must verify ID to be eligible and complete quiz to earn.

For more seasoned traders Coinbase Pro offers a full orderbook with many more trading pairs available. What About Coinbase Pro Tax Documents. This allowance was 12500 for the 20202021 tax year.

The interesting thing about this is that the HMRC in the UK required the exchange to. ¹Crypto rewards is an optional Coinbase offer. Trade Bitcoin BTC Ethereum ETH and more for USD EUR and GBP.

Coinbase reserves the right to cancel the Earn offer at any time. Until now I had used the tried and trusted method of selling BTC to EUR then withdrawing to Revolut via SEPA and exchanging. Trying to find the cheapest and easiest way to deposit to coinbase pro.

Click the menu button at the top right of the Coinbase Pro dashboard and select Statements from the dropdown. You then export your. I have tried to add a UK bank account by sending a transfer via revolut and monzo.

Coinbase UK will share customer details with British tax authorities. United Kingdom Buy sell and convert cryptocurrency on Coinbase. Easily deposit funds via Coinbase bank transfer wire transfer or cryptocurrency wallet.

²Limited while supplies last and amounts offered for each quiz may vary. Now available in United Kingdom and in 100 countries around the world. So it remains the best option for those residing in the UK.

The tax report that CoinTrackinginfo gives you all the information you need to do your tax no matter where you reside. Connect CryptoTraderTax to your Coinbase account with the read-only API. Sign up with Coinbase and manage your crypto easily and securely.

Coinbase is the most trusted place for crypto in United Kingdom. Discover short videos related to coinbase pro taxes on TikTok. Users may only earn once per quiz.

Posted on 07102020 Author Paul Lynam Categories Tax Investigation News. Become tax compliant seamlessly. Easy safe and secure Join 89 million customers.

For example Australias ATO Australian Tax Office the UKs HMRC Her Majestys Revenue and Customs both use different tax metrics. Other countries have similar rules for filing crypto taxes but differences do exist. According to Coinbase.

Your first 12570 of income in the UK is tax free for the 20212022 tax year. Once connected Koinly becomes the ultimate Coinbase Pro tax tool. Coinbase Pro pairs with Koinly through API or CSV file import to make reporting your crypto taxes easy.

Coinbase has told some of its users it is passing their details onto the UK. Support for FIX API and REST API. Overall Coinbase UK boasts the most liquidity when it comes to GBPBTC market.

CEXio has been based and operating in the United Kingdom for a long time. CoinTracker helps you become fully compliant with cryptocurrency tax rules. Allison Murray is a writer based in Chicago.

UK residents who have invested through the American based firm Coinbase will have their details passed to HMRC. If you are a Coinbase Pro customer and you meet their thresholds of more than 200 transactions and 20000 in gross proceeds then you will receive the IRS Form 1099-K instead of the 1099-Misc. There are a couple different ways to connect your account and import your data.

Automatically sync your Coinbase Pro account with CryptoTraderTax via read-only API. To my understanding you can deposit to coinbase then send that to coinbase pro then purchase BTC or any other crypto on coinbase pro. Coinbase Pro Coinbase Tax Resource Center.

Coinbase Pro costs less and uses a maker-taker approach. Let CryptoTraderTax import your data and automatically generate your gains losses and income tax reports. Cryptocurrency exchange Coinbase UK will disclose customer data to the HMRC or Her Majestys Revenue and Customs which is the UKs tax authority in response to the British tax authoritys legal notice according to a crypto tax alert published on twitter.

Coinbase Pro Tax Reporting. Users of the Coinbase exchange to own more than 5000 in cryptocurrency in the UK are going to have the details sent over to the HMRC. Just executed the a first Coinbase Pro GBP direct withdrawal to UK bank account.

File these crypto tax forms yourself send them to your tax professional or import them into your preferred tax filing software like TurboTax or TaxAct. Both returned the amount back by coinbase.

Beginners Guide To Coinbase Pro Coinbase S Advanced Exchange To Trade Btc Eth Ltc Zrx Bat Bch Hackernoon

Trading Page Coinbase Pro Account Price Chart Cryptocurrency Order Book

Coinbase Uk Adds Four Additional Assets Xtz Dai Eos And Link Business Blog Eos Asset

Coinbase Resources For 2019 Tax Returns By Coinbase The Coinbase Blog

Coinbase Debit Card Tax Guide Gordon Law Group

These Are The Bitcoin Alternatives To Watch In 2018 Bitcoin Alternative Ripple

Algorand Algo Is Now Available On Coinbase Buy Cryptocurrency Cryptocurrency Business Blog

Uk Cryptocurrency Tax Guide Cointracker

Bitcoin Helpwithbitcoins Bitcoin Buy Bitcoin Cryptocurrency Trading

/Blockfi_Coinbase_Head_to_Head_Coinbase-46f04333d4464e61821cd0367b1e9ec7.jpg)

Blockfi Vs Coinbase Which Should You Choose

3 Steps To Calculate Coinbase Taxes 2022 Updated

The Complete Coinbase Tax Reporting Guide Koinly

Best Crypto Wallet For Beginners Iphone Friendly Bitcoin Wallet Bitcoin Generator Best Crypto

Coinbase Vs Coinbase Pro What The Difference Crypto Pro

Tax Authority Hmrc Confirms Data Collection From Coinbase Exchange Says Less Than 3 Of U K Customers Impacted

Coinbase 1099 What To Do With Your Coinbase Tax Documents Lexology

/Crypto_com_Coinbase_Head_to_Head_Coinbase-eff66f6b273b4ae6b15b13a318d7300d.jpg)

Crypto Com Vs Coinbase How Do They Compare

Crypto Unicorn Taxbit Joins Forces With Paypal Coinbase Ftx And More To Make Paying Bitcoin And Nft Taxes A Whole Lot Easier