does nc have sales tax on food

The North Carolina NC state sales tax rate is currently 475. Prescription Drugs are exempt from the North Carolina sales tax.

North Carolina 2022 Sales Tax Calculator Rate Lookup Tool Avalara

As of 2014 there were 1012 taxing districts in North Carolina including counties cities and limited meal tax levies.

. County Sales Taxes. Items subject to the general rate are also subject to the. The North Carolina NC state sales tax rate is currently 475.

Qualifying Food A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food. North Carolina Department of Revenue. North Carolina has state sales tax of 475 and allows local governments to collect a local option sales tax of up to 275.

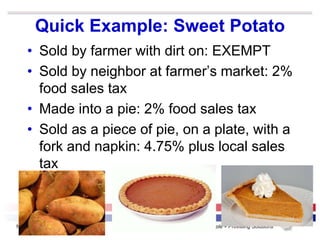

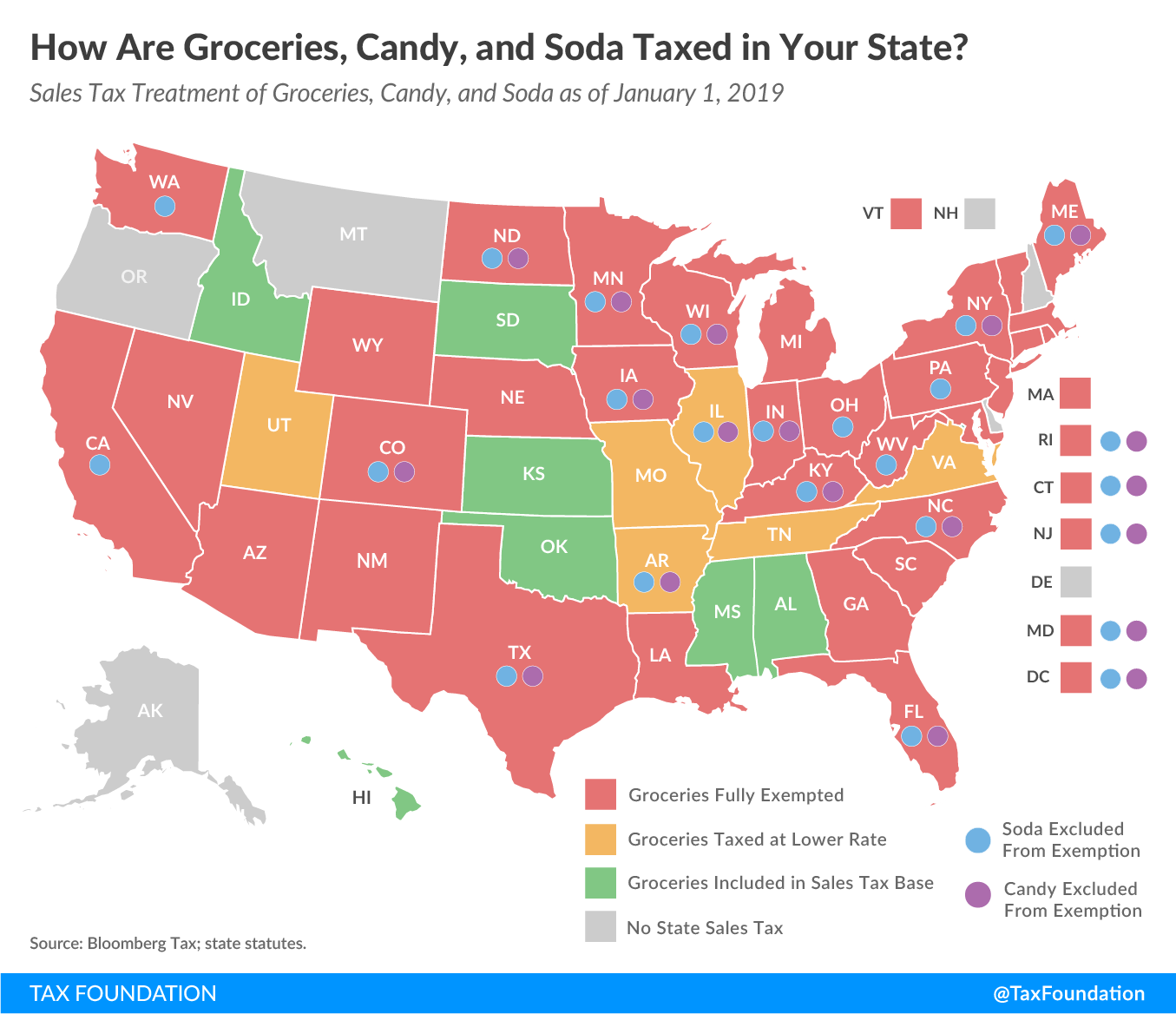

Treat either candy or soda differently than groceries. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. Make Your Money Work A number of categories of goods also have different sales tax rates.

But North Carolina does charge the 2 or 225 percent local sales tax. Arizona grocery items are tax exempt. Counties and municipalities in North Carolina charge additional sales tax with rates between 2 and 275 for a maximum.

We include these in their state sales. While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. The State of North Carolina charges a sales tax rate of 475.

The local sales tax. Highest Effective Sales Tax Rate. However it is only subject to.

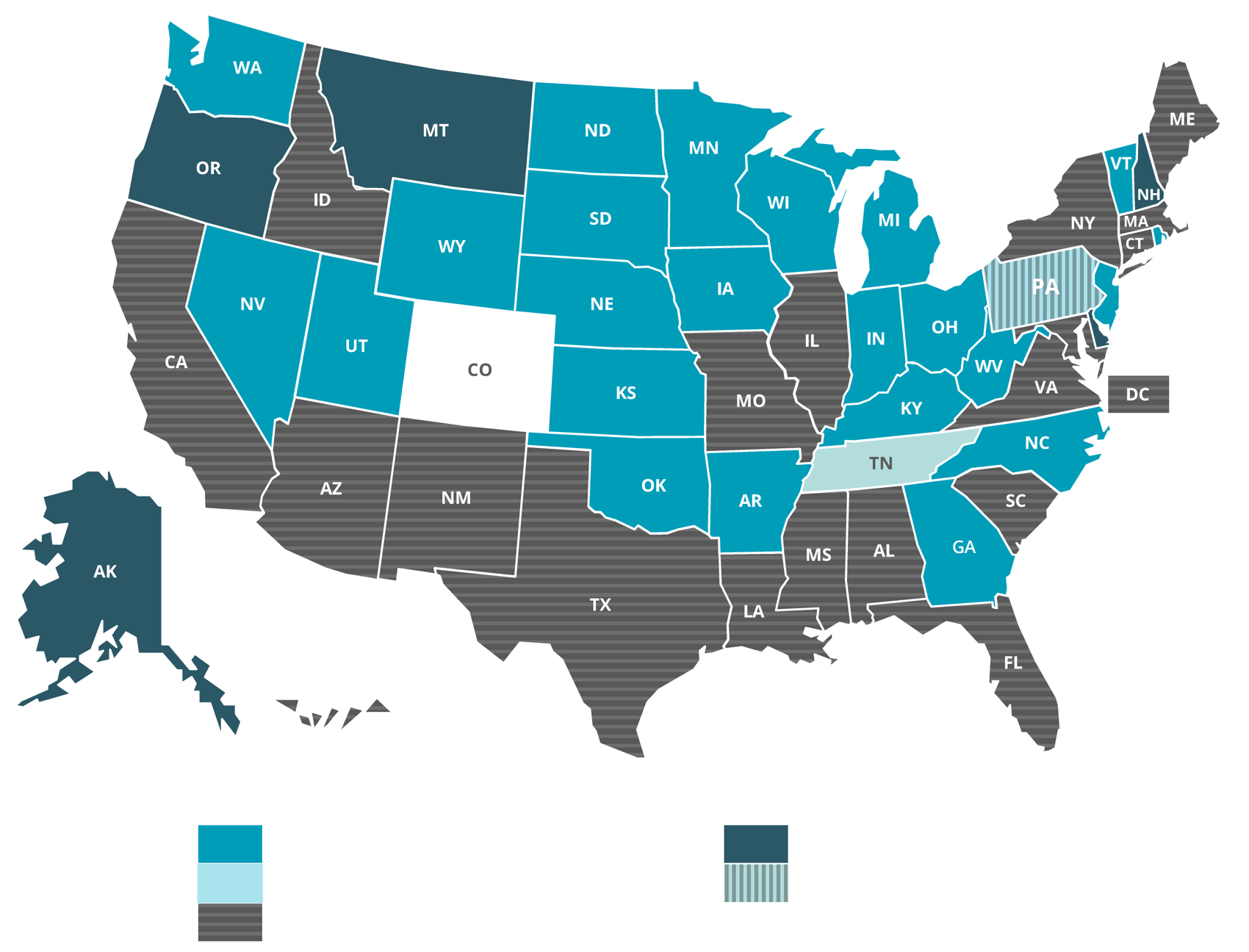

This page describes the taxability of. 53 rows Twenty-three states and DC. Lowest Effective Sales Tax Rate.

2022 List of North Carolina Local Sales Tax Rates. North Carolinas general state sales tax rate is 475 percent. Each of these districts adds its levy to the.

County and local taxes in most areas. The sales tax rate on food is 2. At a total sales tax rate of 675 the total cost is 37363 2363 sales tax.

To learn more see a full. Statewide North Carolina Sales Tax Rate. What transactions are generally subject to sales tax in North Carolina.

Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax. Eleven of the states that exempt groceries from their sales tax base include both. Depending on local municipalities the total tax rate can be as high as 75.

North Carolina Sales Tax. In the state of North Carolina sales tax is legally required to be collected from all tangible physical products being. 35 rows Sales and Use Tax Rates Effective October 1 2020 Skip to main.

A seller that does not have a physical presence in North Carolina and does not have any other legal requirement to register in North Carolina for sales and use tax purposes. Arkansas Grocery items are not tax exempt but food and food ingredients are taxed at a reduced Arkansas state rate of 15 any. Certain items have a 7-percent combined general rate and some items have a miscellaneous.

Why Did Nc Get Rid Of Tax Free Weekends Sales Tax Holiday Explained Charlotte Observer

North Carolina Sales Tax Update

Is Shipping Taxable In North Carolina Taxjar

North Carolina Sales Tax Update

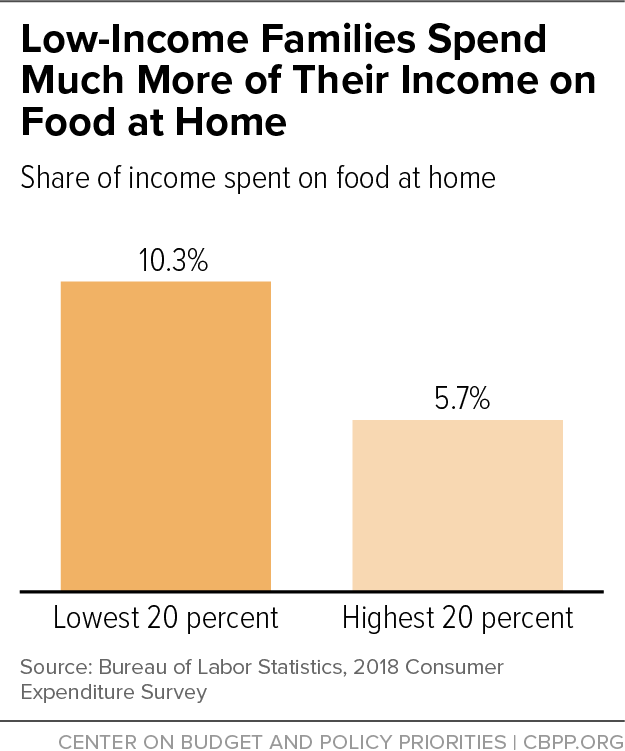

Food Tax Opponents Say Poor Will Suffer Wral Com

North Carolina In 2014 No More Exemption For Food Sold To Students At Colleges And Universities Avalara

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

New York City Sales Tax Rate And Calculator 2021 Wise

How To Register File Taxes Online In North Carolina

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

General Sales Taxes And Gross Receipts Taxes Urban Institute

Sales Taxes In The United States Wikipedia

How Are Groceries Candy And Soda Taxed In Your State

State Level Sales Taxes On Nonfood Items Food And Soft Drinks And Download Table

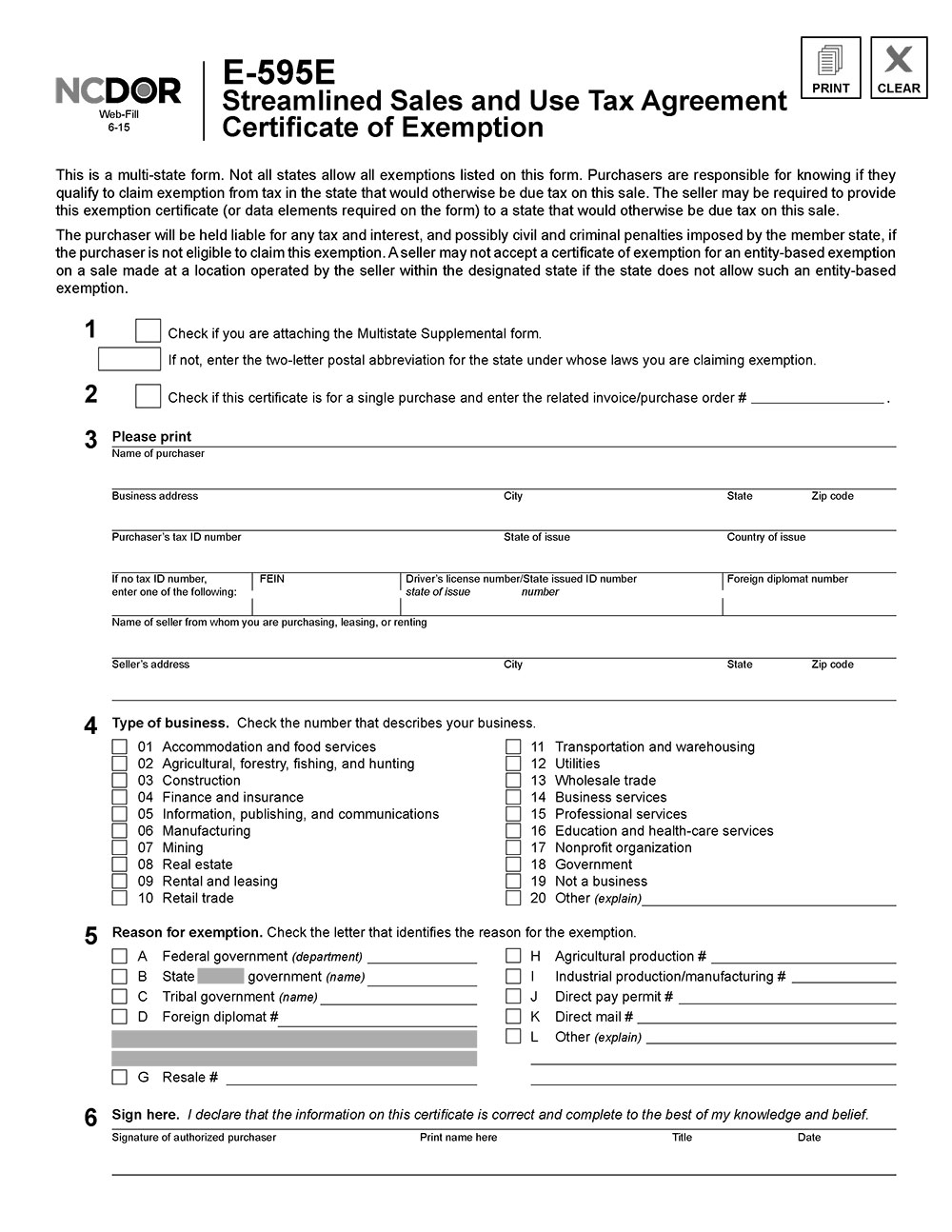

North Carolina Resale Certificate Trivantage

Is Food Taxable In North Carolina Taxjar

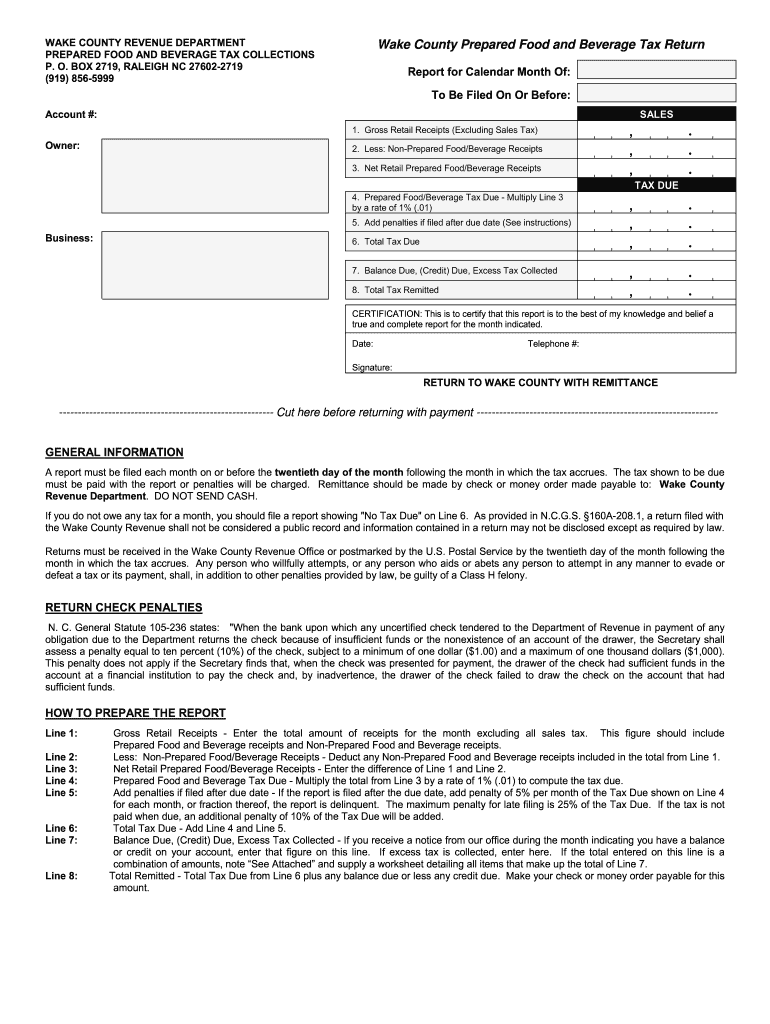

Wake County Prepared Food And Beverage Tax Return Fill And Sign Printable Template Online Us Legal Forms

Kansas Gop House Leader Claims Credit For Food Tax Phaseout The Wichita Eagle