unemployment income tax refund status

State income tax refunds. Specifically the rule allows you to exclude the first 10200.

Irs Tax Refund Calendar 2023 When To Expect My Tax Refund

If you use Account Services.

. The EDD can collect unpaid debt by reducing or withholding the following. To report unemployment compensation on your 2021 tax return. With the fourth batch of payments now going out the IRS has now issued more than 87 million unemployment compensation refunds totaling over 10 billion.

Using the IRS Wheres My Refund tool. Select the State Taxes tab and go through the screens until you see a screen asking whether you want to. You can check the status of your current year refund online or by calling the automated line at 410 260-7701 or 1-800-218-8160.

Unemployment compensation is taxable income which needs to be reported by filing an. The unemployment tax refund is only for those filing individually. Grey Owl by Zdenek Machácek.

President Joe Biden signed the American Rescue Plan a 19 trillion Covid relief bill a month into tax season. Income Tax Refund Information. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by.

Be sure you have a copy of. Is IRS still sending out unemployment refunds. You can amend state if everything looks good.

In the latest batch of refunds announced in November however the average was 1189. However if as a result of the excluded unemployment compensation taxpayers are now. However the American Rescue Plan Act changes that and gives taxpayers a much-needed unemployment tax break.

You may check the status of your refund using self-service. The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket. There are two options to access your account information.

Account Services or Guest Services. Federal income tax refunds. The IRS has cautioned that the refund is is subject to normal offset rules the IRS said meaning that it can be used to cover past-due federal tax state income tax state.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. The first refunds are expected to be issued in May and will continue into the summer. The IRS has sent 87 million unemployment compensation refunds so far.

The unemployment benefits were given to workers whod been laid off as well as self. Funds from unclaimed property. Said it would begin processing the simpler returns first or those eligible for.

The first10200 in benefit. It gives a federal tax break on up to 10200 of unemployment. Viewing your IRS account.

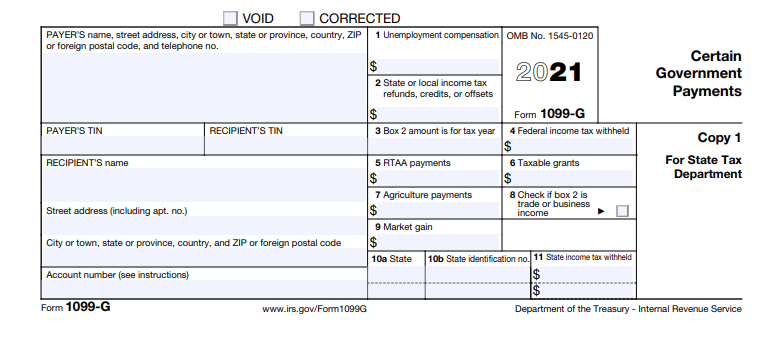

In late May the IRS started. Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form. Unemployment Income and State Tax Returns.

If you received unemployment benefits last yearyou may be eligible for a refund from the IRS. Most taxpayers need not take any action and there is no need to call the IRS.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Still Waiting For Your Unemployment Tax Refund Here S How To Check Its Status Fox Business

What To Know About Irs Unemployment Refunds

Irs Will Automatically Refund Taxes Paid On Some 2020 Unemployment Benefits Ds B

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

Irs Unemployment Refund Status Has My Payment Been Held

Irs Sends Out 4 6 Million Refunds To Taxpayers For Overpayments Wfmynews2 Com

Why Is It Taking So Long To Get My Tax Refund Irs Processing Backlog Updates Aving To Invest

Accessing Your 1099 G Sc Department Of Employment And Workforce

Some May Receive Extra Irs Tax Refund For Unemployment

I Got My Refund News Is Not All Bad Welcome C35 Club 3 5 Facebook

1099 G Unemployment Compensation 1099g

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Irs Refund 2021 Will I Get An Unemployment Tax Check

Guide To Unemployment And Taxes Turbotax Tax Tips Videos

Irs Issues New Batch Of 1 5 Million Unemployment Refunds

Tax Refund Status Is Still Being Processed

Unemployment 10 200 Tax Break Some States Require Amended Returns

If You Got Unemployment Benefits In 2020 Here S How Much Could Be Tax Exempt Abc News